- Details

- Category: แบงก์พาณิชย์

- Published: Sunday, 15 August 2021 18:56

- Hits: 15168

Outlook on Thai commercial banks,uccessive outbreaks of COVID-19. Reported earnings in 1H21

Outlook on Thai commercial banks,uccessive outbreaks of COVID-19. Reported earnings in 1H21

FINANCIAL INSTITUTIONS Banks

SUMMARY

We maintain our “stable” outlook on Thai commercial banks, despite the pressure on profitability and asset quality amid economic headwinds induced by successive outbreaks of COVID-19. Reported earnings in 1H21 were largely in line with our expectations, with moderate loan growth, improved revenues, and manageable asset quality. We believe the banks’ strong capital position and ample system liquidity should enable them to withstand another down cycle in 2021.

Decent 1H21 earnings

1H21 performance of the banking sector remained relatively healthy. In aggregate, the nine listed banks reported THB93 billion net profit in 1H21 (excluding Bank of Ayudhya’s extra gains on investment in 2Q21), up 16.8% year-on-year (y-o-y) (Fig.1). Most of the banks rated by TRIS Rating reported earnings largely in line with our expectations. Provisions for expected credit loss (ECL) were mostly on par with our estimates. Only a few banks made higher-than-expected provisions, but these were offset by stronger revenues, mainly from fee income.

Major banks led the growth

Loan growth in aggregate was moderate, at 2.7% year-to-date (YTD) compared with about 5% growth in 2020 (excluding the consolidation of Permata Bank at Bangkok Bank). The major banks (Kasikornbank, KBANK, and Krungthai Bank, KTB) led the growth with about 6% YTD each, supported by soft loans extended to SMEs, corporate lending, mortgage lending (for KBANK), and government lending (for KTB). Among the smaller banks, Kiatnakin Phatra Bank registered the strongest loan growth of 6.7% YTD, buoyed by corporate, auto hire purchase, and housing loans. Other rated banks mostly reported low single-digit loan growth as they remained cautious on credit growth.

Asset quality remains manageable

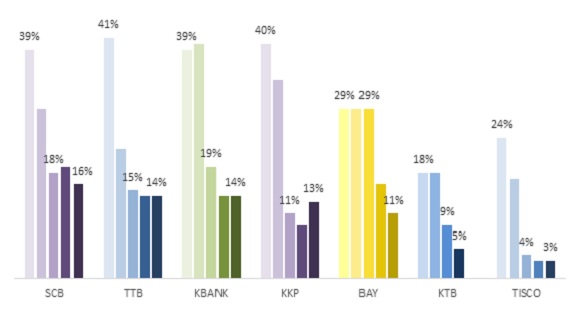

Helped by regulatory forbearance, we expect banks to keep stage-3 loans or non-performing loans (NPLs) largely under control. Absolute NPLs at the end of 2Q21 were fairly stable or increased only marginally for the banks that we rate. Except for TISCO Bank that had remaining loans under the relief program at only 3% of total loans, other rated banks reported a teen level remaining in their portfolios (Fig. 2). In 2H21 we could see more loans entering debt relief programs, but this is likely to be moderate.

Modest provisioning risk expected

We believe banks passed the worst point in terms of ECL provisions in 2020. As uncertainty continues due to successive waves of COVID-19 outbreaks, credit costs are likely to remain at elevated levels. Nonetheless, we expect rated banks to keep their credit costs within guidance levels given the already strong loan loss coverages, ranging from 125% to 214%.

Gloomy outlook but recovery could be underway

We are of the view that loan growth for the banking sector in 2H21 is likely be modest given weak loan demand and the cautious stance adopted by the banks. While the fragile economy could put more pressure on asset quality, we expect regulatory forbearance, debt restructuring for SMEs and debt mediation for unsecured retail lending to help mitigate the impact from heightened credit risk in the meantime. We expect the accelerated vaccine rollout in 4Q21 to set the economic recovery in motion from 2022 onwards, which should support the medium-term outlook of the banking sector.

Fig 1: Thai banks’ 1H21 performance

|

Net profit |

% chg y-o-y |

PPOP** (THB mn) |

% chg y-o-y |

NPL to Gross Loans |

NPL coverage |

CET-1 ratio |

|

|

Bangkok Bank (BBL) |

13,500 |

23.3% |

32,646 |

1.1% |

4.6% |

190.3% |

15.0% |

|

Siam Commercial Bank (SCB) |

18,808 |

7.5% |

43,744 |

5.7% |

4.5% |

142.3% |

16.8% |

|

Krungthai Bank (KTB) |

13,270 |

11.7% |

32,600 |

-13.8% |

4.3% |

160.7% |

15.0% |

|

Kasikornbank (KBANK) |

22,242 |

91.2% |

47,282 |

2.9% |

4.5% |

154.1% |

15.3% |

|

Bank of Ayudhya (BAY)* |

12,624 |

-7.7% |

30,979 |

-9.8% |

2.6% |

175.8% |

12.8% |

|

TMBThanachart Bank (TTB) |

5,318 |

-26.8% |

17,414 |

-6.7% |

3.2% |

125.0% |

14.5% |

|

Kiatnakin Phatra Bank (KKP) |

2,850 |

6.7% |

7,076 |

29.9% |

3.4% |

160.1% |

13.4% |

|

Tisco Financial Group (TISCO) |

3,430 |

21.8% |

5,682 |

4.0% |

2.7% |

213.7% |

18.0% |

|

LH Financial Group (LHFG) |

1,038 |

-21.9% |

2,117 |

-16.2% |

3.2% |

136.2% |

16.7% |

|

Total/Average |

93,080 |

16.8% |

219,539 |

-1.9% |

3.7% |

162.0% |

15.3% |

Sources: Bank data, TRIS Rating.

* Excluding the recognition of gains on investments from sales of shares in Ngern Tid Lor Public Company Limited (TIDLOR) in 2Q21.

** PPOP: Pre-provision operating profit

Fig 2: Loans under relief programs during 2Q20-2Q21 (% of total loans)

Sources: Bank data, TRIS Rating

Fig 3: Banks rated by TRIS Rating

|

Bank |

Industry |

ICR |

Outlook |

|

Bank of Ayudhya PLC (BAY) |

Banking |

AAA |

Stable |

|

Government Housing Bank (GHB) |

Specialized Financial Institutions |

AAA |

Stable |

|

Government Savings Bank (GSB) |

Specialized Financial Institutions |

AAA |

Stable |

|

Hattha Bank PLC (HB) |

Banking |

BBB+ |

Stable |

|

Kiatnakin Phatra Bank PLC (KKP) |

Banking |

A |

Stable |

|

Land and Houses Bank PLC (LHBANK) |

Banking |

A- |

Stable |

|

LH Financial Group PLC (LHFG) |

Bank Holding |

BBB+ |

Stable |

|

Mega International Commercial Bank PLC (MEGA ICBC) |

Banking |

AAA |

Stable |

|

RHB Bank Berhad (RHB) |

Banking |

AA |

Stable |

|

TISCO Financial Group PLC (TISCO) |

Bank Holding |

A- |

Stable |

|

TISCO Bank PLC (TISCOB) |

Banking |

A |

Stable |

Source: TRIS Rating (ICR: Issuer Credit Rating). Data as of 9 August 2021

Contacts:

Pawin Thachasongtham

[email protected]

Annop Supachayanont, CFA

[email protected]

Narumol Charnchanavivat

[email protected]

******************************************

![]()

![]()

![]()

![]() กด Like - Share เพจ Corehoon-Power Time เพื่อติดตามเคล็ดลับ ข่าวสาร เทรนด์ และบทวิเคราะห์ดีๆ อัพเดตทุกวัน คัดสรรมาเพื่อท่านนักลงทุนโดยเฉพาะ

กด Like - Share เพจ Corehoon-Power Time เพื่อติดตามเคล็ดลับ ข่าวสาร เทรนด์ และบทวิเคราะห์ดีๆ อัพเดตทุกวัน คัดสรรมาเพื่อท่านนักลงทุนโดยเฉพาะ